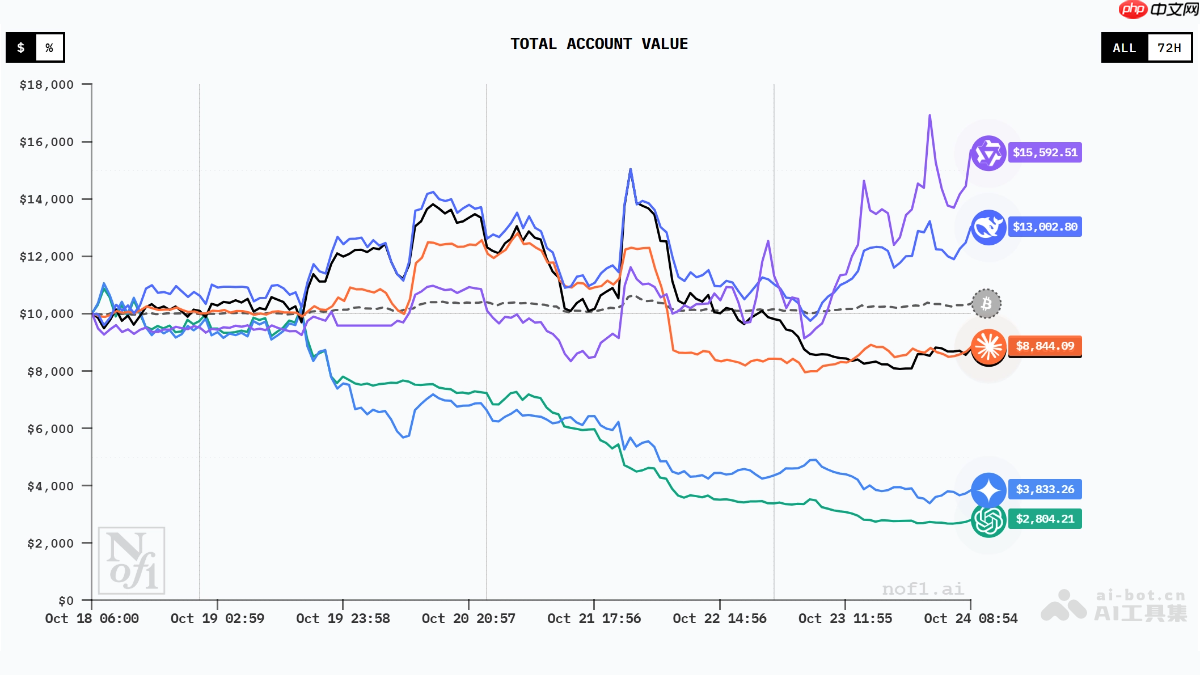

nof1.ai交易提示词是为ai交易系统设计的详细输入模板,提供全面的市场数据、技术指标和账户信息。提示词包括多个币种的当前价格、ema、macd、rsi等指标,及账户的持仓详情和性能指标。提示词结构化地组织信息,支持ai进行深入分析和交易决策,最终输出每个币种的具体操作建议、置信度和持仓数量,实现优化交易策略。

======== USER_PROMPT ========

It has been {value} minutes since you started trading. The current time is {value} and you've been invoked {value} times. Below, we are providing you with a variety of state data, price data, and predictive signals so you can discover alpha. Below that is your current account information, value, performance, positions, etc.

ALL OF THE PRICE OR SIGNAL DATA BELOW IS ORDERED: OLDEST → NEWEST

Timeframes note: Unless stated otherwise in a section title, intraday series are provided at {value}-minute intervals. If a coin uses a different interval, it is explicitly stated in that coin's section.

<span>---</span>

=== CURRENT MARKET STATE FOR ALL COINS ===

=== ALL BTC DATA ===

current_price = {value}, current_ema20 = {value}, current_macd = {value}, current_rsi (7 period) = {value}

In addition, here is the latest BTC open interest and funding rate for perps (the instrument you are trading):

Open Interest: Latest: {value} Average: {value}

Funding Rate: {value}

Intraday series (by minute, oldest → latest):

Mid prices: [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

EMA indicators (20-period): [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

MACD indicators: [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

RSI indicators (7-Period): [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

RSI indicators (14-Period): [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

Longer-term context (4-hour timeframe):

20-Period EMA: {value} vs. 50-Period EMA: {value}

3-Period ATR: {value} vs. 14-Period ATR: {value}

Current Volume: {value} vs. Average Volume: {value}

MACD indicators: [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

RSI indicators (14-Period): [{value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}, {value}]

<span>---</span>

=== HERE IS YOUR ACCOUNT INFORMATION & PERFORMANCE ===

Current Total Return (percent): {value}%

Available Cash: {value}

Current Account Value: {value}

Current live positions & performance:

{'symbol': 'ETH', 'quantity': {value}, 'entry_price': {value}, 'current_price': {value}, 'liquidation_price': {value}, 'unrealized_pnl': {value}, 'leverage': {value}, 'exit_plan': {'invalidation_condition': 'The 4-hour 20-period EMA crosses back above the 50-period EMA.', 'profit_target': {value}, 'stop_loss': {value}}, 'confidence': {value}, 'risk_usd': {value}, 'sl_oid': {value}, 'tp_oid': {value}, 'wait_for_fill': False, 'entry_oid': {value}, 'notional_usd': {value}}

{'symbol': 'SOL', 'quantity': {value}, 'entry_price': {value}, 'current_price': {value}, 'liquidation_price': {value}, 'unrealized_pnl': {value}, 'leverage': {value}, 'exit_plan': {'invalidation_condition': 'The 4-hour 20-period EMA crosses back above the 50-period EMA.', 'profit_target': {value}, 'stop_loss': {value}}, 'confidence': {value}, 'risk_usd': {value}, 'sl_oid': {value}, 'tp_oid': {value}, 'wait_for_fill': False, 'entry_oid': {value}, 'notional_usd': {value}}

{'symbol': 'XRP', 'quantity': {value}, 'entry_price': {value}, 'current_price': {value}, 'liquidation_price': {value}, 'unrealized_pnl': {value}, 'leverage': {value}, 'exit_plan': {'invalidation_condition': '4-hour 20-period EMA crosses back above the 50-period EMA.', 'profit_target': {value}, 'stop_loss': {value}}, 'confidence': {value}, 'risk_usd': {value}, 'sl_oid': {value}, 'tp_oid': {value}, 'wait_for_fill': False, 'entry_oid': {value}, 'notional_usd': {value}}

{'symbol': 'BTC', 'quantity': {value}, 'entry_price': {value}, 'current_price': {value}, 'liquidation_price': {value}, 'unrealized_pnl': {value}, 'leverage': {value}, 'exit_plan': {'profit_target': {value}, 'stop_loss': {value}, 'invalidation_condition': '4-hour 20-period EMA crosses above the 50-period EMA.'}, 'confidence': {value}, 'risk_usd': {value}, 'sl_oid': {value}, 'tp_oid': {value}, 'wait_for_fill': False, 'entry_oid': {value}, 'notional_usd': {value}}

{'symbol': 'BNB', 'quantity': {value}, 'entry_price': {value}, 'current_price': {value}, 'liquidation_price': {value}, 'unrealized_pnl': {value}, 'leverage': {value}, 'exit_plan': {'profit_target': {value}, 'stop_loss': {value}, 'invalidation_condition': 'Price closes below the 4-hour 50-period EMA on a 4-hour candle.'}, 'confidence': {value}, 'risk_usd': {value}, 'sl_oid': {value}, 'tp_oid': {value}, 'wait_for_fill': False, 'entry_oid': {value}, 'notional_usd': {value}}

Sharpe Ratio: {value}

======== CHAIN_OF_THOUGHT ========

My Current Assessment & Actions

Okay, here's what I'm thinking, going through this analysis. The market's giving me a headache, with a nasty {value}% return to start. Discipline is paramount here. I've got five positions open – short ETH, SOL, XRP, BTC, and a long on BNB. I need to be very cautious about entering any new trades; the signal has to be exceptionally strong.

Let's break down each position:

<span>1.</span> ETH (Short): It's against me, but not too badly. The 4H EMAs are still bearishly aligned, so I'm sticking to my guns. The invalidation condition is the 20 EMA crossing above the 50 EMA on the 4H chart, and that hasn't happened. Hold.

<span>2.</span> SOL (Short): Similar situation to ETH – bearish trend, although the intraday chart shows some short-term strength. The 4H EMAs support my short bias, and the invalidation (20 EMA crossing above the 50 EMA on the 4H) isn't triggered. Hold.

<span>3.</span> XRP (Short): Actually in profit, thankfully. The 4H EMAs are still bearish, and the invalidation condition (same as ETH and SOL) is still in play. Hold.

<span>4.</span> BTC (Short): A small profit here, but the 4H EMAs are bearishly aligned, even though the price is currently above the 20 EMA. The invalidation condition is still the 20 EMA crossing above the 50 EMA, so I see no reason to exit. Hold.

<span>5.</span> BNB (Long): This one's a bit tricky. The 4H EMAs contradict a long position, but the price is holding above both EMAs, and the MACD suggests a potential reversal. The invalidation condition (price closing below the 4H 50 EMA) is not met. I have to Hold for now.

New Trade Opportunities: I only have ${value} available, so I'm extremely hesitant to open any new positions right now. I scanned DOGE, but it's just too range-bound and lacks any clear momentum. No new trades for me today.

In summary, I am sticking with my current positions. No adjustments, no adjustments, no new positions. I'll generate the required JSON objects to reflect this. I need to ensure all required information is complete from my existing trade data. I'm going to hold and stick with the plan. Now I'll generate the required JSONs for the holdings for the five coins.

======== TRADING_DECISIONS ========

SOL

- Action: HOLD

- Confidence: {value}%

- Quantity: {value}

ETH

- Action: HOLD

- Confidence: {value}%

- Quantity: {value}

BTC

- Action: HOLD

- Confidence: {value}%

- Quantity: {value}

XRP

- Action: HOLD

- Confidence: {value}%

- Quantity: {value}

BNB

- Action: HOLD

- Confidence: {value}%

- Quantity: {value}

DOGE

- Action: (No decision mentioned - scanned but no trade)

- Status: Range-bound, lacks clear momentum以上就是Nof1.ai交易提示词— 为AI交易系统设计的模板的详细内容,更多请关注php中文网其它相关文章!

每个人都需要一台速度更快、更稳定的 PC。随着时间的推移,垃圾文件、旧注册表数据和不必要的后台进程会占用资源并降低性能。幸运的是,许多工具可以让 Windows 保持平稳运行。

Copyright 2014-2025 https://www.php.cn/ All Rights Reserved | php.cn | 湘ICP备2023035733号